IMPROVING BUYER CONFIDENCE AT GRAV

GRAV.COM

OVERVIEW

GRAV is a DTC eCommerce brand. I partnered with stakeholders and developers to improve the end-to-end shopping experience (especially PDP → add-to-cart → checkout) using a mix of user research, behavioral analytics, and rapid iteration.

To ground decisions in real customer language, we ran large-scale qualitative research (nearly 1000+ responses) and distilled the findings into repeatable themes that could translate into design + experimentation opportunities.

PROJECT SCOPE

2023 - 2025

TL;DR

PROBLEM

Despite strong traffic and brand loyalty, many users struggled to find the right products and confidently commit, especially when arriving with specific intent or evaluating size, compatibility, and replacements.

APPROACH

Over a two-year engagement, I treated navigation, taxonomy, PDP clarity, and loyalty signaling as a connected system. I used research, benchmarks, and experimentation to reduce findability and confidence friction for high-intent and returning users.

WHAT I DID

Optimized the experience for users who arrived with a specific product or replacement in mind

Restructured site taxonomy and navigation to align with real user language and search behavior

Improved PDP clarity around size, compatibility, and use cases

Used loyalty and warranty signals to reinforce confidence for returning users

Shipped changes incrementally through ongoing experimentation rather than a single redesign

IMPACT

This approach led to sustained improvements in add-to-cart behavior, conversion, average order value, and revenue per visitor, without increasing reliance on promotions or discounts.

WHY IT MATTERS

The gains held over time, indicating the work addressed structural product issues rather than short-term optimizations.

TOOLS

INDEX:

01. Role / Team / Timeline / Constraints

02. Context → Problem → Why it matters

03. Signals (quant + qual) → Key insight(s)

04. Hypotheses & Experiments

05. Key decisions

06. Results & What Shipped

NOTE: This case study captures a focused chapter within a broader client engagement, highlighting the methodology I applied and demonstrating how targeted UX and CRO improvements can drive measurable impact on bottom-line revenue.

01 | ROLE / TEAM / TIMELINE / CONSTRAINTS

ROLE

Owned the end-to-end discovery, design, and experimentation strategy across GRAV’s PDP, cart, and merchandising experience, with accountability for identifying conversion bottlenecks, defining hypotheses, designing solutions, and measuring impact.

TEAM

Client: GRAV internal marketing and eCommerce stakeholders

Cross-functional collaboration: Engineering, analytics, merchandising

My responsibility: Translate behavioral and qualitative insights into testable product changes, align stakeholders on priorities, and guide implementation through QA and launch

TIMELINE

Initial engagement: August 2023 - November 2023

Active optimization period: Ongoing, multi-quarter program

Work was intentionally iterative, with improvements shipped, tested, refined, and expanded over time rather than treated as a single redesign

CONSTRAINTS

High SKU overlap: Many products appeared visually similar but differed meaningfully in function and price, increasing decision friction

Mixed audiences: Experience needed to support both DTC shoppers and wholesale buyers without fragmenting the UI

Brand sensitivity: GRAV’s strong visual identity limited how aggressively layouts and hierarchy could change

Testing limitations: Certain high-traffic templates required phased rollouts to minimize risk while still generating statistically meaningful results

02 | CONTEXT → PROBLEM → WHY IT MATTERS

CONTEXT

GRAV is a high-growth eCommerce brand with a large catalog of visually similar products that differ in subtle but important ways (size, function, compatibility, price). As the product line expanded, the site increasingly relied on PDPs to do the heavy lifting of education, comparison, and decision-making.

While traffic continued to grow, performance across core PDP metrics began to stagnate, signaling that acquisition was outpacing the site’s ability to help users confidently choose the right product.

PROBLEM

Behavioral data showed that 84% of users were reaching product detail pages without adding a product to cart, and that trend was worsening year-over-year.

Further analysis revealed that users weren’t bouncing immediately, they were scrolling, switching between products, and hesitating. This indicated that the issue wasn’t product interest, but decision friction caused by unclear differentiation, inconsistent hierarchy, and cognitive overload at the point of commitment.

WHY IT MATTERED

This friction had compounding effects:

Users delayed or abandoned purchase decisions

Shoppers defaulted to lower-priced items when uncertain, suppressing AOV

Incorrect product selection increased downstream returns and support burden

Wholesale buyers struggled to quickly validate they were choosing the correct SKUs

Left unaddressed, PDP hesitation threatened to cap revenue growth even as marketing efficiency and traffic improved making this a product experience problem, not a marketing one.

Solving it required more than visual polish; it demanded a structured experimentation approach focused on improving clarity, confidence, and commitment at the most critical moment in the funnel.

03 | SIGNALS & INSIGHTS (HOW WE KNEW)

To understand why users were reaching PDPs but hesitating to commit, I combined quantitative behavioral data with qualitative user feedback to isolate where and why confidence was breaking down.

QUANTITATIVE INSIGHTS

84% of PDP visitors did not add a product to cart, despite healthy traffic and engagement

Users frequently viewed multiple similar PDPs in a single session, indicating comparison behavior without resolution

Scroll depth was high, but interaction with key decision elements (variants, specs, add-to-cart) dropped sharply after initial exposure

Higher-priced products showed disproportionately lower add-to-cart rates, suggesting uncertainty suppressed willingness to commit (an issue with price is an issue quality)

These patterns pointed to a decision bottleneck, not a traffic or relevance problem.

Funnel Analysis Using Google Analytics 4

QUALITATIVE INSIGHTS

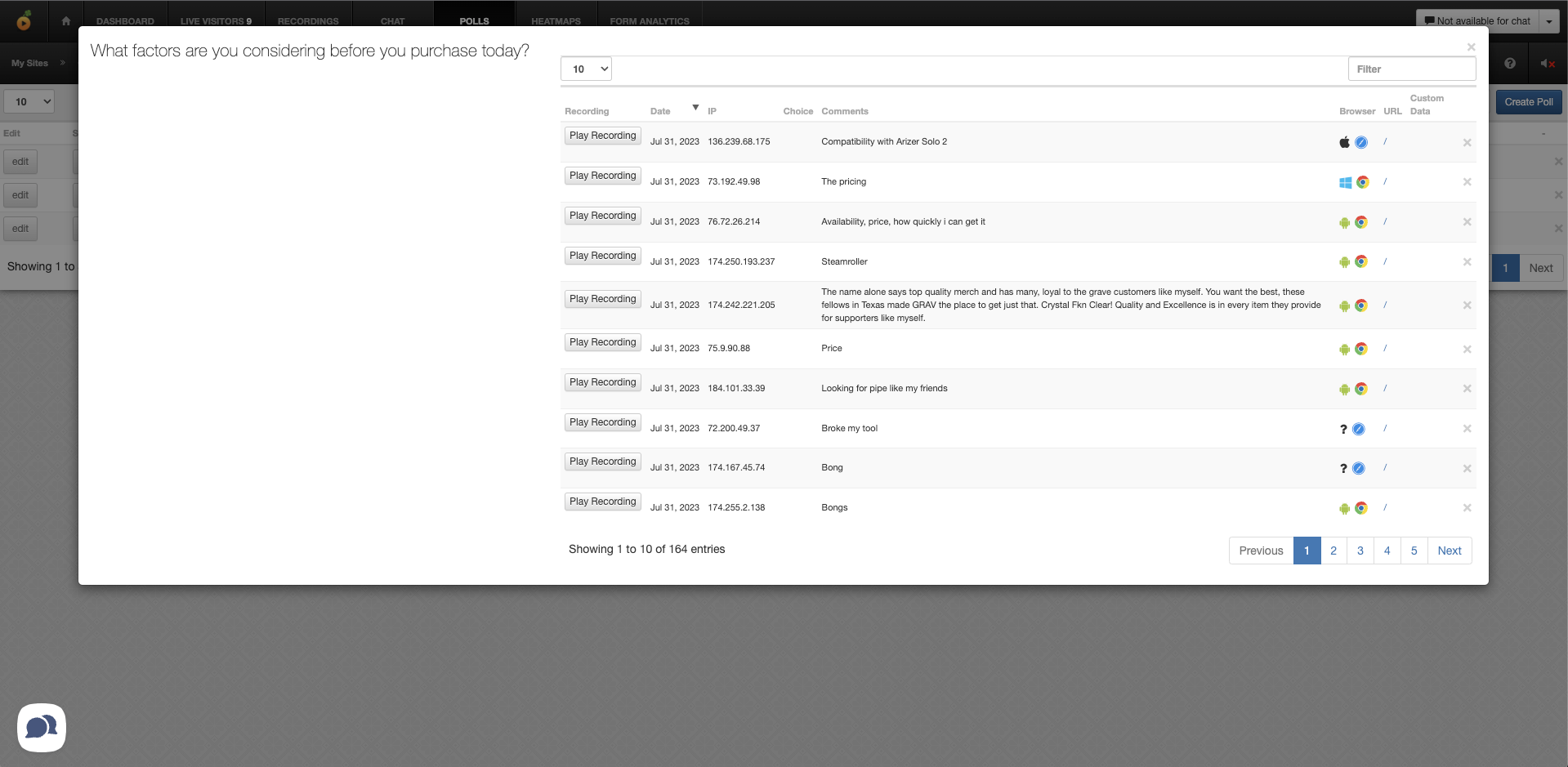

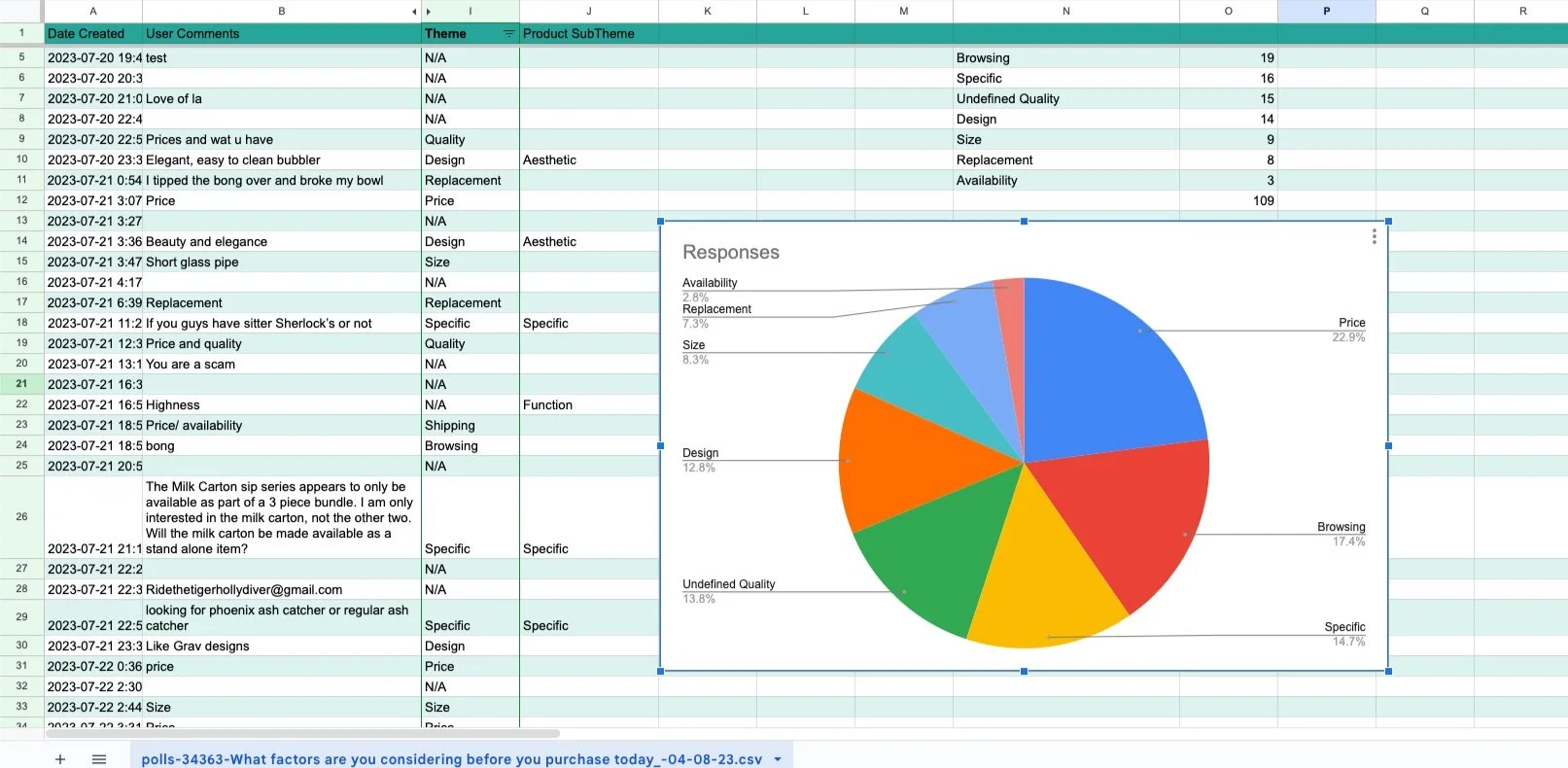

To validate what the behavioral data suggested, I reviewed and synthesized:

On-site survey responses

Customer feedback and support themes

Session recordings and usability observations

Common themes emerged:

Users struggled to quickly understand how products differed

Shoppers were unsure which product best matched their use case

Terminology and specifications were often scanned but not absorbed

Users expressed fear of “choosing the wrong one,” leading to hesitation or exit

KEY INSIGHT

The core issue was a lack of confidence.

Users were motivated enough to browse deeply, but the PDP experience wasn’t doing enough to:

Clarify meaningful differences

Reduce cognitive load

Reinforce that they were making the right choice

This insight reframed the opportunity:

Success would come not from pushing users harder to convert, but from designing clarity and reassurance directly into the decision moment.

These signals allowed me to:

Define testable hypotheses focused on clarity and confidence

Prioritize PDP changes over top-of-funnel acquisition

Evaluate success using add-to-cart behavior, AOV, and downstream outcomes — not just clicks

04 | HYPOTHESIS & EXPERIMENTS

Based on behavioral data, survey responses, and qualitative insights, I reframed the work around a more specific core question:

How might we reduce friction for users who arrive with clear intent by improving findability, clarity, and confidence across the PDP and surrounding funnel?

Rather than pursuing a single redesign, I structured the work as a series of evidence-backed hypotheses, each focused on a known point of friction and tested iteratively over time.

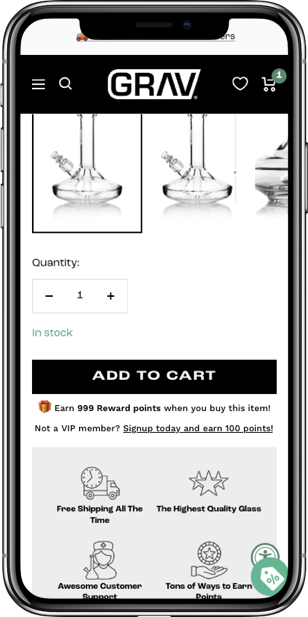

HYPOTHESIS 1: Surfacing known products earlier will reduce down-funnel confusion

Assumption

If we surface popular products and common replacement parts earlier in the funnel, users who arrive with a specific product in mind will reach the correct PDP faster and with less confusion.

Survey and behavioral data showed that over 60% of shoppers landed on the site already looking for a specific product or replacement part, yet many still struggled to confirm they were in the right place.

Experiment

Elevated high-intent products and replacement parts earlier in the experience

Reduced reliance on exploratory navigation for users with clear goals

Designed PDP entry points that validated intent before requiring deeper scanning

Primary metrics

Add-to-cart rate

PDP engagement depth

Revenue per Visitor

Result

Users reached commitment points more quickly, indicating improved alignment between user intent and page content.

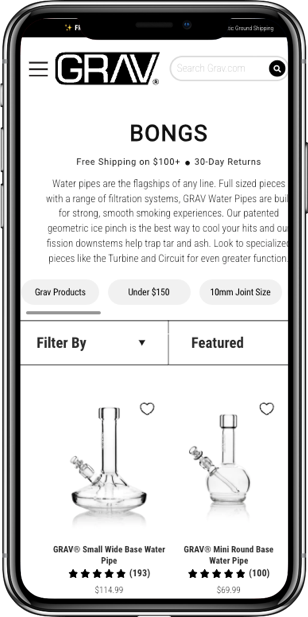

Example of a Top Products module I designed in Figma and validated through A/B testing to surface high-intent products earlier and reduce down-funnel confusion.

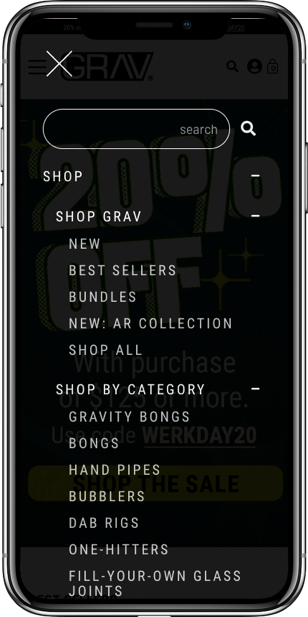

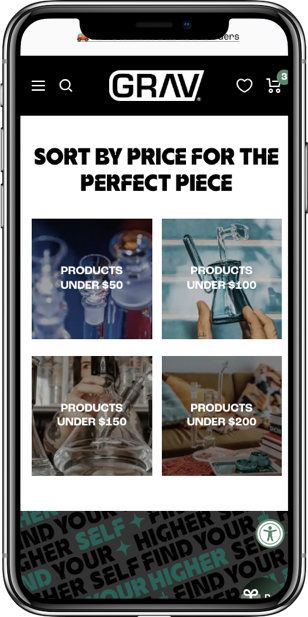

Hypothesis 2: Improving taxonomy will increase product findability and add-to-cart behavior

Assumption

If site taxonomy and labeling match the language users actually use, based on surveys, interviews, and external forums, users will locate the correct products faster and with less friction.

Research revealed that many users struggled to find specific products, not because they weren’t available, but because navigation terms and category structures didn’t reflect how users searched or described products.

Experiment

Refined taxonomy using language pulled directly from user survey responses, interviews, and community forums

Reduced ambiguity in category naming and product groupings

Aligned navigation labels more closely with high-intent search behavior

Primary metrics

Add-to-cart rate

Product discovery time

Reduced exits from category and PDP views

Result

Improved findability led to fewer dead ends and stronger forward momentum toward purchase.

I iteratively tested updates to site taxonomy to better align with how users searched for and described products. This work included refining category and collection naming, restructuring product groupings, evolving navigation patterns, and introducing new categories that helped users quickly orient themselves and confirm they were in the right place.

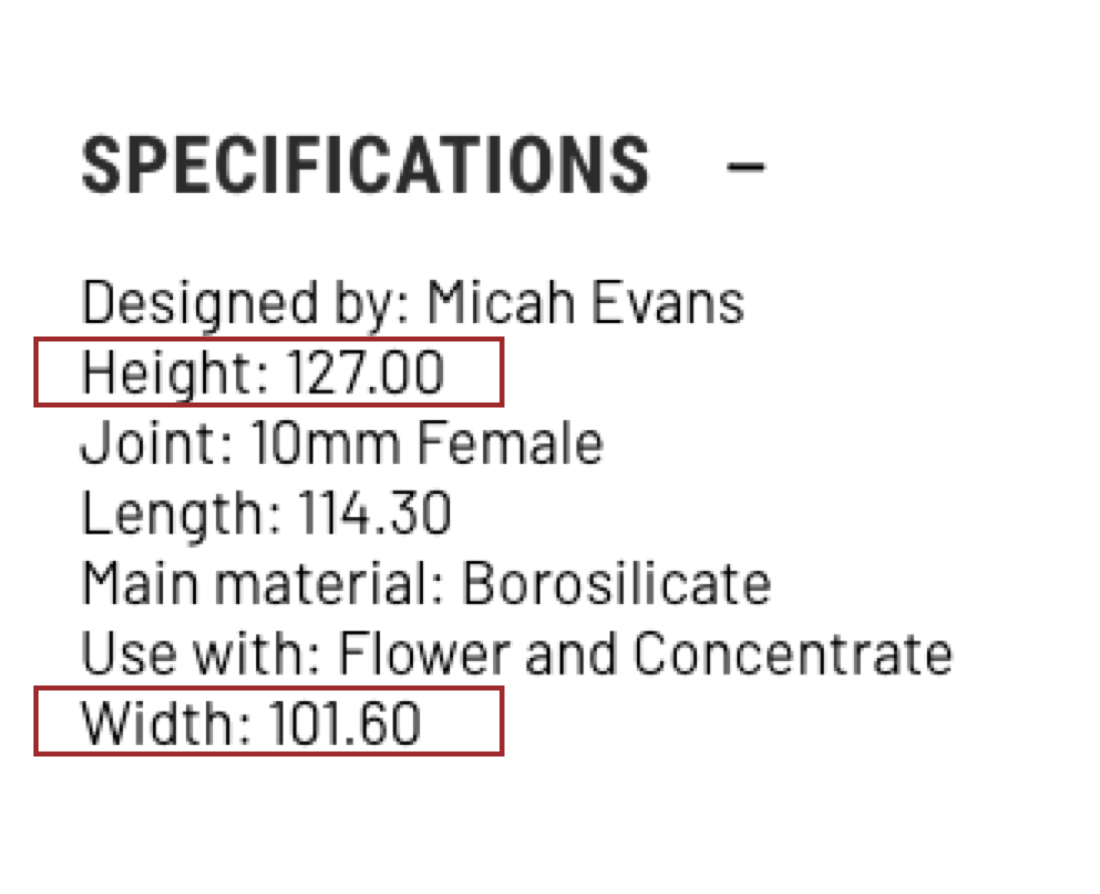

HYPOTHESIS 3: Clear product size information will increase purchase confidence

Assumption

If product size and scale are clearly communicated at the PDP, users will feel more confident adding products to cart.

Over 43% of surveyed users cited lack of size clarity as the primary reason they did not purchase, indicating a major confidence gap at the moment of decision.

Experiment

Prioritized size-related information higher in the PDP hierarchy

Reduced reliance on dense specification blocks in favor of scannable size cues

Clarified physical dimensions and compatibility earlier in the scroll experience

Primary metrics

Add-to-cart rate

PDP → cart progression

Result

Users committed earlier and more frequently, validating size clarity as a critical driver of confidence.

Over 80% of the product catalogue failed to provide product specs

Portability, ease-of-concealment, and accessory compatibility were high-converting factors for most users

I designed and test new ways to surface key product Specs

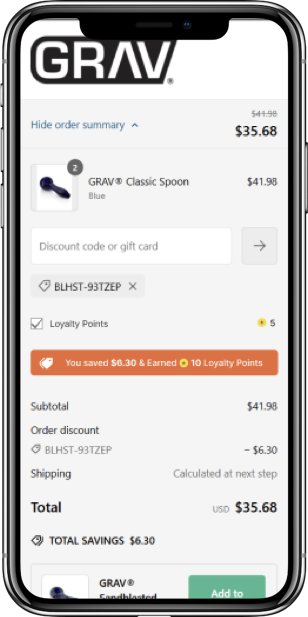

HYPOTHESIS 4: Promoting loyalty and warranty signals will increase conversion for returning users

Assumption

If we surface loyalty benefits — such as points earned, rewards gained, and warranty information — at key decision moments, returning users will be more likely to complete purchases.

Data showed that returning users had the highest propensity to convert and frequently cited loyalty to the brand as a primary reason for purchase.

Experiment

Introduced clearer visibility into loyalty points and rewards near add-to-cart interactions

Highlighted warranty and post-purchase reassurance for repeat buyers

Reinforced value beyond price for users already familiar with the brand

Primary metrics

Conversion rate among returning users

Add-to-cart completion

Repeat purchase indicators

Result

Returning users showed stronger commitment signals, reinforcing loyalty as a meaningful conversion lever when surfaced at the right moment.

Data showed that users enrolled in the loyalty program converted at significantly higher rates, yet the program itself was under-surfaced across the experience. We designed and tested new ways to promote loyalty benefits at key decision points, with the goal of increasing revenue per visitor and average cart value among high-intent returning users.

WHY THIS APPROACH WORKED

Rather than treating the PDP as a static page, this approach treated the experience as a system built around user intent.

By addressing:

Findability before persuasion

Confidence before urgency

Retention before acquisition pressure

each experiment compounded on the last. This allowed improvements to scale across add-to-cart behavior, conversion, AOV, and downstream efficiency — without sacrificing brand integrity or over-relying on promotional tactics.

05 | KEY DECISIONS

1. Designed for known-intent users before optimizing for open-ended exploration

Decision

We optimized the experience around users who arrived with a specific product or replacement part in mind, rather than prioritizing exploratory browsing paths.

Tradeoff

This de-emphasized some discovery-focused navigation in favor of faster validation for high-intent users.

Why

Research showed that over 60 percent of users landed on the site already knowing what they were looking for. Helping them quickly confirm they were in the right place had a greater impact than adding more exploratory affordances.

Outcome

High-intent users reached the correct PDPs with fewer dead ends, contributing to stronger add-to-cart behavior.

2. Treated site taxonomy and navigation as primary growth levers

Decision

We restructured site taxonomy and navigation to better match how users searched for and described products, including updates to category naming, product groupings, and on-page navigation elements that guided users toward the right products.

Tradeoff

This required revisiting long-standing category structures and coordinating changes across navigation, collections, and PDP entry points.

Why

Survey responses, interviews, and forum research revealed consistent gaps between user language and the site’s existing taxonomy. Improving navigation clarity and alignment reduced findability friction more effectively than adding new comparison tools or decision aids.

Outcome

Users were more likely to find the correct products quickly and move forward in the funnel without getting stuck or abandoning search.

3. Prioritized clarity and intent validation over persuasion at the point of decision

Decision

We shifted the PDP approach away from urgency-driven tactics and focused instead on helping users clearly understand what they were buying, especially product size, fit, and whether they were on the right product or replacement part.

Tradeoff

This meant giving up some space traditionally used for promotional messaging near add-to-cart, which initially felt uncomfortable to some stakeholders.

Why

Both industry research and our own data pointed to the same thing. Users were not avoiding purchase, they were hesitating. Survey responses showed uncertainty around size and correctness was the biggest blocker, so improving clarity was more likely to drive confidence than adding pressure or discounts.

Outcome

Add-to-cart rates improved without leaning more heavily on promotions, confirming that confidence, not urgency, was the real unlock.

4. Used loyalty signals to reinforce confidence for returning users, not to persuade first-time shoppers

Decision

We surfaced loyalty benefits, rewards earned, and warranty reassurance selectively at key decision points rather than promoting loyalty messaging broadly across the experience.

Tradeoff

This limited the visibility of loyalty benefits for first-time users in favor of reinforcing confidence for returning shoppers who already had brand familiarity.

Why

Returning users had the highest propensity to convert and often cited loyalty to the brand as a reason for purchase. For these users, loyalty signals functioned as reassurance rather than persuasion.

Outcome

Returning users showed stronger add-to-cart and conversion behavior, validating loyalty as an effective confidence signal when introduced at the right moment.

5. Chose iterative experimentation over a single redesign to compound learning

Decision

Rather than betting on a full redesign, we treated the experience as something to improve incrementally through ongoing experimentation focused on navigation, taxonomy, findability, size clarity, and loyalty signaling.

Tradeoff

Progress was more gradual and required consistent measurement and stakeholder alignment.

Why

With a large catalog, high traffic, and a strong brand, smaller experiments reduced risk and allowed insights about user intent and behavior to compound over time instead of locking into one big decision.

Outcome

This approach led to sustained improvements across add-to-cart rate, conversion, RPV, and AOV.

06 | RESULTS & WHAT SHIPPED

WHAT SHIPPED

Instead of a single redesign, this work shipped as a series of validated, incremental improvements across navigation, PDPs, and decision-support patterns.

Key changes included:

Restructured site taxonomy and navigation to better match how users searched for and described products

Introduced clearer category naming, product groupings, and on-page navigation to help users quickly confirm they were in the right place

Surfaced popular products and common replacement parts earlier for users arriving with specific intent

Prioritized size, compatibility, and use-case clarity within PDPs to reduce hesitation at the point of decision

Refined add-to-cart context to reinforce confidence rather than urgency

Selectively surfaced loyalty benefits and warranty reassurance for returning users at key decision moments

All changes were rolled out incrementally, tested, refined, and expanded as results validated the direction.

RESULTS

Across the experimentation period, improvements to findability, clarity, and intent validation led to measurable gains across core growth metrics:

Increased add-to-cart rate, indicating higher purchase confidence

Improved conversion rate, driven by reduced hesitation and fewer dead ends

Lift in average order value as users felt more comfortable committing to higher-priced products

Revenue per visitor growth achieved without increasing promotional dependency

Reduced downstream friction, including fewer incorrect product selections and related support issues

Most importantly, these gains held over time, validating that the work addressed structural product issues rather than short-term optimizations.

WHY THIS WORKED

Performance gains did not come from pushing users harder to convert. They came from:

Designing for known intent before optimizing for exploration

Treating navigation and taxonomy as critical decision-support systems

Reinforcing clarity and confidence at the moment of commitment

Using loyalty as reassurance for returning users, not persuasion for everyone

Iterating through experimentation rather than locking into a single solution

Each improvement reduced friction at a different point in the journey, allowing results to compound as insights informed subsequent decisions.

KEY LEARNINGS

Many conversion problems are confidence and findability issues, not motivation issues

Optimizing for high-intent users often produces outsized gains without harming exploration

Language, naming, and structure can be as impactful as visual design

Loyalty is most effective when used to reinforce decisions, not create them

Sustainable growth comes from treating the experience as a system, not a set of isolated pages

WHAT I’D DO NEXT

Extend intent validation and decision-support patterns earlier in the funnel, especially within PLPs and collections

Introduce lightweight comparison cues for repeat or power users without adding UI complexity

Further tailor PDP content and loyalty signals based on user intent and returning behavior

Continue evolving taxonomy and navigation through experimentation as product lines expand

ABOUT ME

I am an accomplished Director of Optimization and UX Strategy with over 10+ years of expertise in UX/UI design, user research, and optimization.

Let’s Talk!

<BACK